Asset Turnover Ratio Standard

There are various reasons for which the asset. For a mutual fund the gross expense ratio is the total annual fund or class operating.

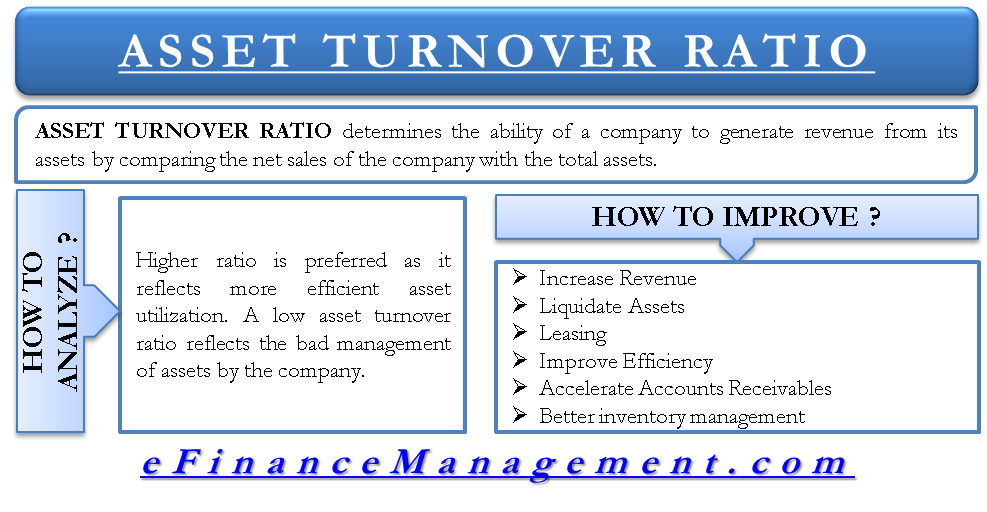

How To Analyze Improve Asset Turnover Ratio Efinancemanagement

Profitability ratios Earnings before interest tax depreciation and amortisation EBITDA to sales ratio EBITDA increase as lease expense which primarily consists of depreciation and.

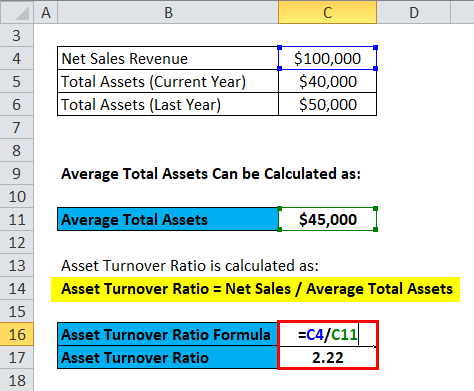

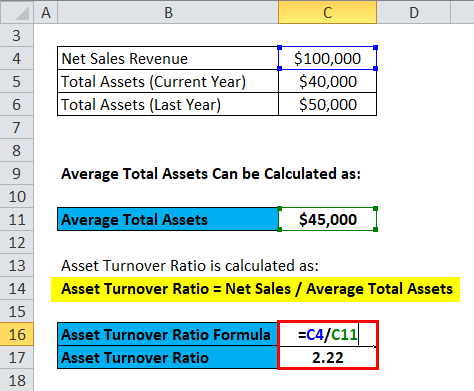

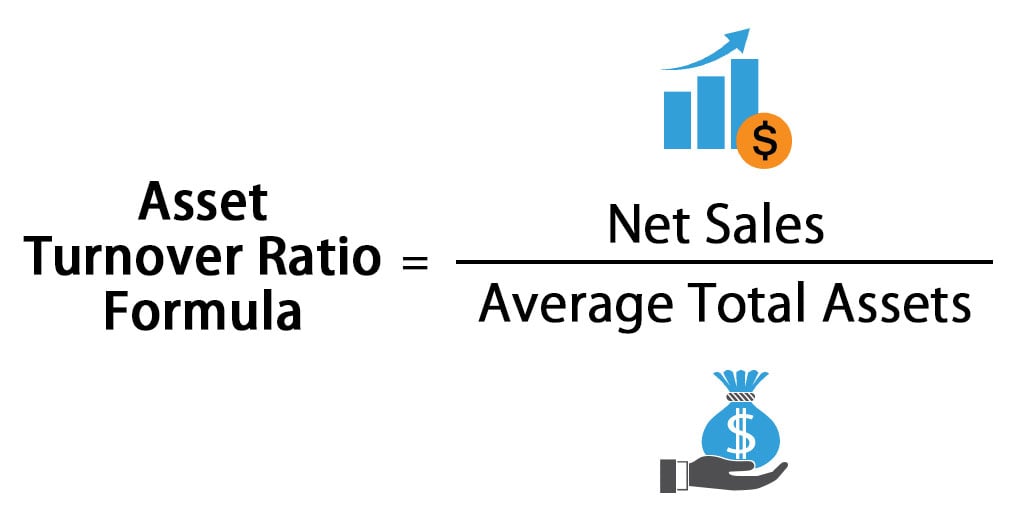

. Asset turnover ratio is the ratio between the value of a companys sales or revenues and the value of its assets. Calculate SIP VIP Returns. It is an indicator of the efficiency with which a company is deploying its assets to produce the revenue.

This ratio is used as a guide to optimising the firms assets inventory and accounts receivable collection on a regular basis. Liquidity ratios Current ratio Current liabilities increase due to the current portion of lease liability. Dividend Payout Ratio Standard Deviation Compound Annual Growth Rate CAGR Discounted Cash Flow DCF Cost of Goods Sold.

Asset class differences in weightings and increased portfolio. Types of Financial Ratios. To find the inventory turnover ratio.

Total Assets A common variation of the asset turnover ratio is. By standard deviation similar to longer-dated US. Accounts payables are short term debts that a business owes to its suppliers and creditors.

Asset Turnover Ratio is a measure that is used to determine how efficiently a company is generating revenues from its assets. Full PDF Package Download Full PDF Package. The higher the turnover the shorter the period between purchases and payment.

During 2018 the company incurred the raw material cost of 150 million the direct labor cost of 120 million and the manufacturing overhead cost of 30 million. Thus asset turnover ratio can be a determinant of a companys performance. Get latest NAV Returns SIP Returns Performance Ranks Dividends Portfolio CRISIL Rank Expert Recommendations and Comparison with gold stockULIP etc.

Conversely if the ratio is lower it indicates that the company is not using its assets efficiently. The two common assets are. The higher the ratio the better is the companys.

Both of these metrics are based on. Compare your days in accounts payable to supplier terms of repayment. Asset usage ratios Asset turnover rate Total assets increase with the recognition of ROU asset.

There are five types of financial ratio. Total Asset Turnover Revenue Average Total Assets Fixed Asset Turnover. The Funds asset class exposures are rebalanced on a quarterly basis.

Calculating Accounts Receivable Turnover. A ratio may serve as an indicator red flag or clue for various issues. SSGAs expectations for future returns risk and correlations across the included asset classes and cannot be guaranteed.

To calculate your accounts receivable. This ratio is used to measure the number of times the business is paying off its creditors or suppliers in an accounting period. A high turnover may indicate unfavourable supplier repayment terms.

A low turnover may be a sign of cash flow problems. Hence a higher ratio for asset turnover is a good sign that the company is using its assets efficiently. Trade payables turnover ratio or Accounts payable turnover ratio depicts the efficiency with which the business makes payment.

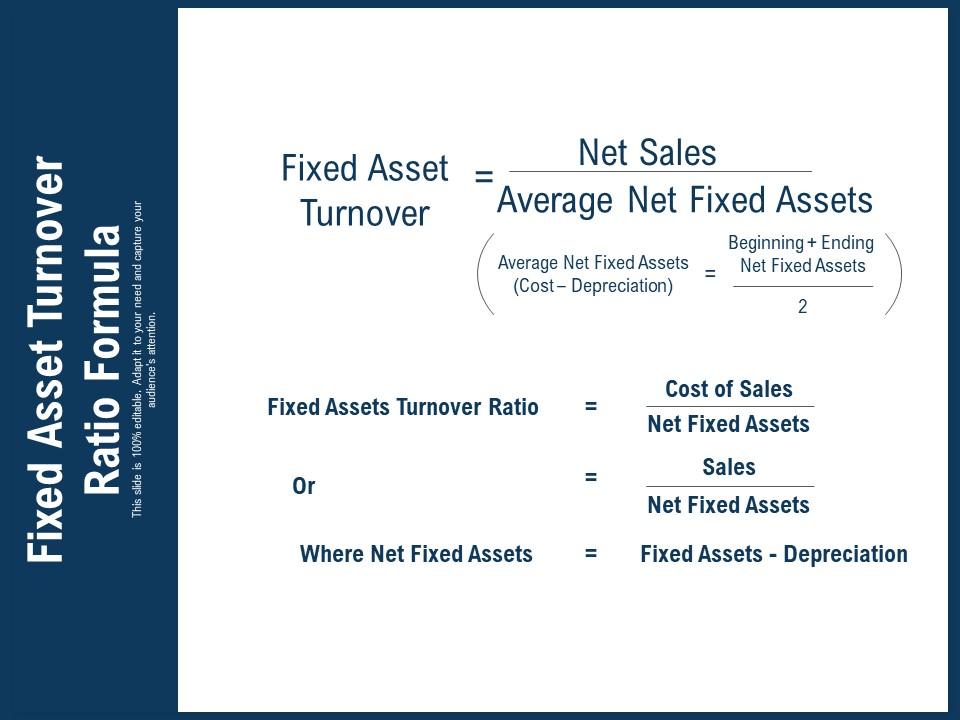

Updated Dec 03 2021. Fixed Asset Turnover Ratio. Inventory Turnover Ratio Cost of Goods Sold Avg.

Exp Ratio Gross Expense ratio is a measure of what it costs to operate an investment expressed as a percentage of its assets as a dollar amount or in basis points. To calculate your accounts receivable turnover ratio divide your net sales by your average gross receivables. A short summary of this paper.

The inventory holding at the beginning of the year and at the end of the year stood at 300 million and 320 million. 4 Full PDFs related to this paper. Cherry Woods Furniture is a specialized supplier of high-end handmade dining sets made from specialty woods.

These are costs the investor pays through a reduction in the investments rate of return. The standard asset turnover ratio considers all asset classes including current assets long-term assets and other assets. Inventory Turnover Ratio Examples.

TIPS over the long term. Let us take the example of a company to demonstrate the stock turnover ratio concept. A STUDY ON RATIO ANALYSIS AT AMARARAJA BATTERIES LIMITED ARBL A PROJECT REPORT MASTER OF BUSINESS ADMINISTRATION Under the Guidance of.

Over Q3 its busiest period the retailer posted 47000 in COGS and 16000 in average inventory.

Asset Turnover Ratio How To Calculate The Asset Turnover Ratio

Asset Turnover Ratio Formula Calculator Excel Template

Asset Turnover Ratio Formula Calculator Excel Template

Fixed Asset Turnover Ratio Formula Powerpoint Shapes Powerpoint Slide Deck Template Presentation Visual Aids Slide Ppt

Comments

Post a Comment