Describe What a Tariff Is and Its Economic Effects

Looking for the textbook. Economic Effects of Tariffs A tariff is a tax imposed by a state on goods and services imported or exported to or from a given country.

Effect Of Tariffs Economics Help

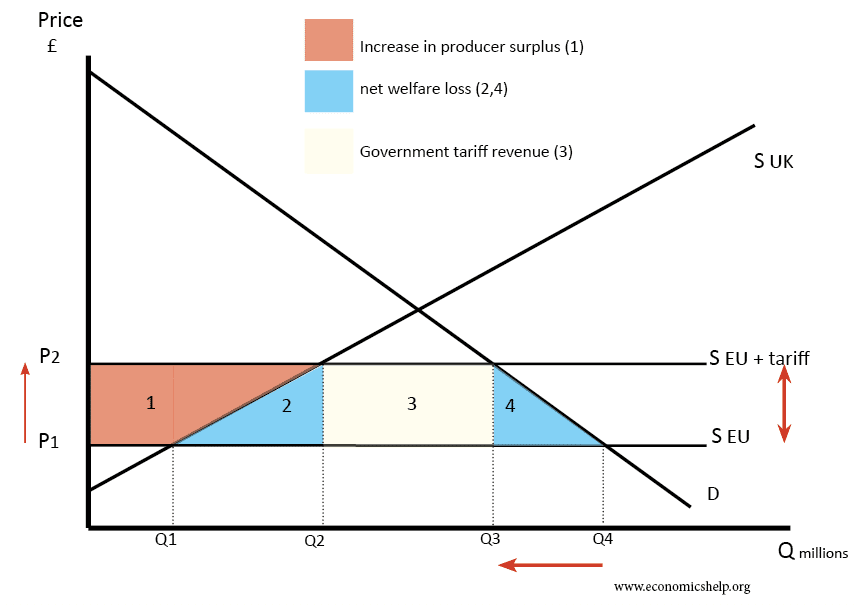

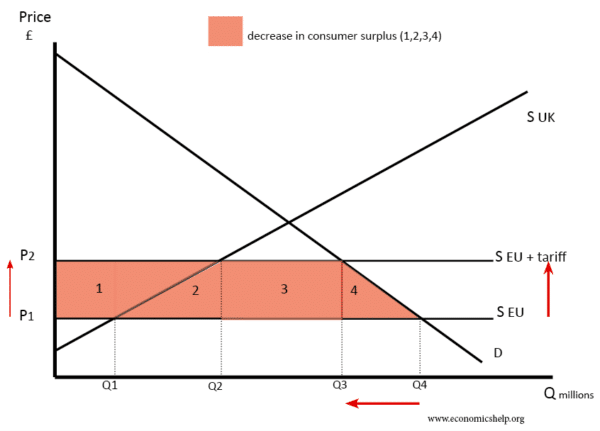

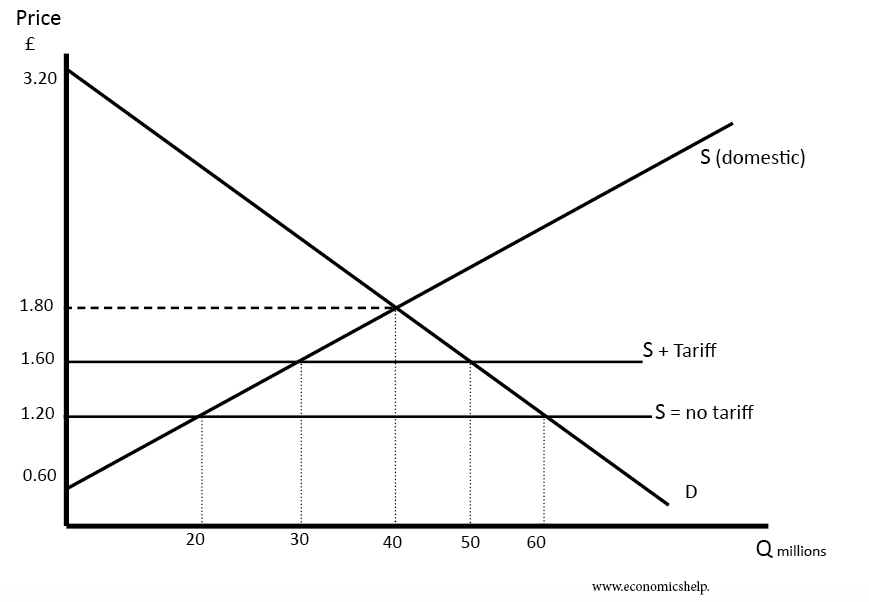

This simple description enables us to identify the partial equilibrium effects of a tariff as follows.

. Indeed one of the purposes of the WTO is to enable Member countries to negotiate mutual tariff reductions. Get solutions Get solutions done loading. Describe what a tariff.

Customs authorities impose tariffs on goods arriving at a nations borders. Start your trial now. A tariff is a tax imposed by one country on the goods and services imported from another country.

Principles of Microeconomics 7th Edition Edit edition. Describe the larger economic effects of the policies in the previous question. This problem has been solved.

As a tariff raises the price of a product it reduces the domestic quantity demanded and raises the domestic quantity supplied. Tariffs are taxes levied on imported goods. The purpose is to limit foreign imports protect domestic employment reduce competition among domestic industries and increase government revenue.

In simplest terms a tariff is a tax. First week only 499. It adds to the cost borne by consumers of imported goods and is one of several trade policies that a.

Tariffs have historically been a tool for governments to collect revenues but they are also a way for governments. In our illustration this price effect is an increase in the price of G equal to the rate of tariff T. Price effect of an import tariff is the change in the domestic price of G which has been subjected to an import duty.

If a country is exporting this good the tariff has no effect on them. 9780324600902 9780324824490 9780324824599 9780324824636 9780324824704 9781111115968 9781111806989. A tariff is a type of tax levied by a country on an imported good at the border.

Describe what a tariff is and its economic effects. DESCRIBE WHAT A TARIFF IS AND ITS ECONOMICS EFFECT. A tariff increases the internal.

Describe what a tariff is and its economic effects. Describe what a tariff is and its economic effectsA tariff is a tax on good produced abroad and sold domestically. Describe what a tariff is and its economic effects.

This moves the domestic market closer to its equilibrium without trade. A tariff is a tax imposed on the import or export of goodsIn general parlance. Solution for Describe what a tariff is and its economic effects.

A tariff is a tax on imported goods. Describe the larger economic effects of the policies in the previous question. List five arguments often given to support trade restrictions.

A tariff is a charge levied on imported goods. What is the difference between the unilateral and multilateral approaches to achieving. Trade barriers such as tariffs have been demonstrated to cause more economic harm than benefit.

How do economists respond to these arguments. Describe what a tariff is and its economic effects. A tariff is a tax that is imposed on imported commodities.

View the full answer. Answer Tariffs are the most common kind of barrier to trade. David W Skully has written.

Although domestic producers are better off and the government raises revenue the losses to consumers exceed these gains. Economics of tariff-rate quota administration -- subjects. The tariff is essential only if the country is an importer.

A tariff raises the price of imported goods above the world price by the amount of the tariff and brings it closer to the price that would prevail without trade by reducing quantity of imports. Principles of Macroeconomics 5th Edition Edit edition Solutions for Chapter 9 Problem 4QR. Describe what a tariff is and its economic effects.

That is what would be the effects on income consumption employment interest rates and real exchange rates of policies designed to reduce or eliminate the current account deficit. Countries can sign free trade agreements to. A tax on imports-moves a market closer to the equilibrium that would exist without trade and therefore reduces the gains from trade.

Note that the price rise equals the tariff rate because H is a small. To understand the impact of tariffs on domestically manufactured goods this article uses the Producer Price. They raise prices and reduce availability of goods and services thus resulting on net in lower income reduced employment and lower economic output.

Solutions for Chapter 9 Problem 4QR. Economic aspects Economic aspects of Wheat Tariff Tariff on farm produce Tariff on sugar Tariff.

Effect Of Tariffs Economics Help

:max_bytes(150000):strip_icc()/TariffsAffectPrices1_2-e3858c9eddb649a8b3ffc70af1f9938b.png)

The Basics Of Tariffs And Trade Barriers

/TariffsAffectPrices1_2-e3858c9eddb649a8b3ffc70af1f9938b.png)

Comments

Post a Comment